Amber Diagnostics has an extensive selection of high quality refurbished and used medical imaging equipment for sale

Mobile Options

Mobile MRI, CT & PET/CT Scanners

Our top-tier MRI, CT, and PET/CT scanners are available to ensure seamless patient care and uninterrupted diagnostics.

For RentalFor Sale

Looking to sell your medical imaging equipment?

We buy used MRI, CT and PET/CT Scanners, C-Arms, Portable X-rays and other imaging equipment

how it Works

We Make it Easy

Amber Diagnostics has over 25 years of experience in the Medical Imaging Equipment industry and strives to provide high quality service to doctors and medical institutions.

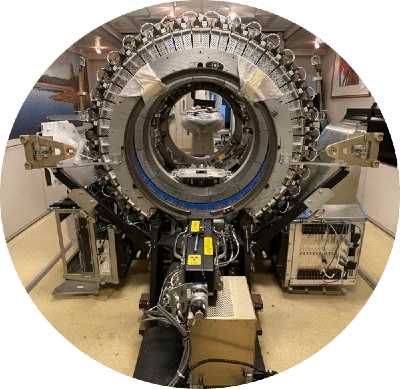

Refurbishment

We transform imaging equipment back into like-new condition so you can grow your business without going over budget.

Pack and Ship

We offer domestic and international shipping. Whether you need ocean or air export, we handle the process quickly and safely.

Site Preparation

We provide you with a blueprint that details from equipment location to wiring diagrams to ensure a smooth, planned-out process.

Installation

Our experienced service engineers and technicians will handle the installation safely while working around your facility’s schedule.

WE Have Many Options

Featured Equipment

Revolutionizing healthcare with used cutting-edge medical imaging equipment.

Let Us Help You

Grow Your Business

Download our helpful Buyer’s Guides that contain vital information regarding costs, parts, site planning, maintenance, and more. We also have a Return On Investment Calculator to help you determine how your investment is going to help your business.

Get Started

Request Pricing Today!

We’re here to help! Simply fill out the form to tell us a bit about your needs. We’ll contact you to set up a conversation so we can discuss how we can best meet your needs. Thank you for considering us!

Great support & services

Save time and energy

Peace of mind

Risk reduction